Adapted from Dr. Claes Fornell's book | July 16, 2017

The Satisfied Customer: Winners and Losers in the Battle for Buyer Preference

Surprisingly few companies keep track of customers lost, gained, and retained. But it's critical to do so.

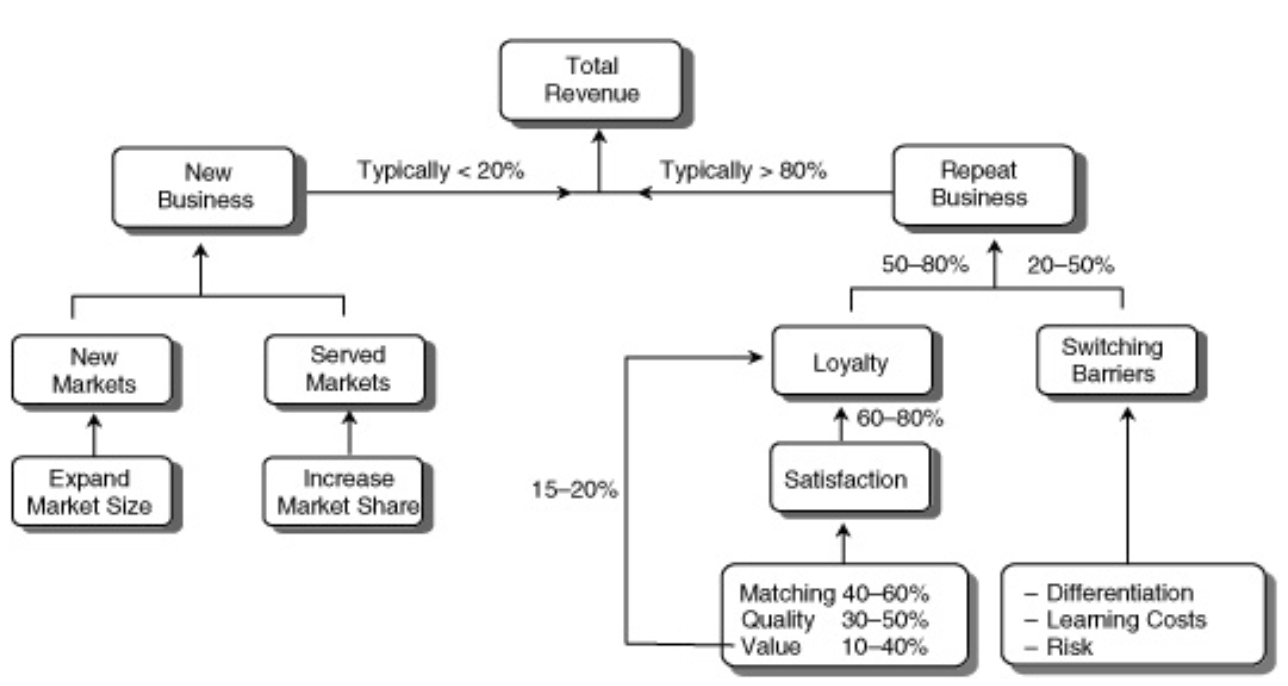

Customer retention can be measured in several ways, but all relate in one way or another to the proportion of customers (or accounts) retained per time period (a year, quarter, etc.). For many companies, 70 to 80 percent of the total revenue represents the proportion from repeat business.

Suppose Volvo cars have 70 percent customer retention. That is, 70 percent of the current Volvo owners will buy a Volvo next time. What happens if we could increase that number by two—for a customer retention rate of 72 percent instead of 70 percent? In other words, if Volvo invested in customer satisfaction and, because of the increasing satisfaction, customer retention moved up to 72 percent, what's the return on that investment?

Let's begin in the simplest manner possible, without considering present value analysis, profit margins, time horizons, or retention probability distributions. If 70 percent of my customers return, how many purchases would they give me? Since I am losing 30 percent of my customers each purchase cycle, the average customer would be worth 70/30 = 2.3 purchases. At 72 percent customer retention, the average customer would be worth 72/28 = 2.7 purchases. That is, 0.4 more purchases. That's a gain of 17 percent.

So, an improvement by 2 percentage points in customer retention produces a 17 percent increase in the value of the customer asset, measured as volume of purchases over time. Unless it's going to cost me a great deal to accomplish this, it seems like a pretty nice return.

The returns on customer retention explain why it is that firms with satisfied customers do much better financially than others. They also explain why it pays off to invest in such firms.

To get a more precise estimate of the value of customer assets, one needs to take profit margins, the time horizon, and the cost of money into account. Sunil Gupta and Don Lehmann discuss this in some detail, but they nevertheless conclude that customer retention is the key factor.1 It has a much greater effect than the discount rate and the time horizon.

There are many models for estimating the customer lifetime value in the technical literature.2 Obviously, profit margins can have a great effect, but they may vary over the time horizon. In fact, profit margins may go up if highly satisfied customers are less costly to serve, less sensitive to price increases, and don't need as much reselling.

But profit margins may go down if customers exercise more power and competition gets tougher. The returns on customer retention explain why it is that firms with satisfied customers do much better financially than others. They also explain why it pays off to invest in such firms. Not only is the return greater, but the risk is smaller due to the stability of cash flows for loyal customers.

Now then, how do we manage to increase customer retention, without attempting to monopolize, which is not only difficult but may have risky long-term consequences, and to refrain from lowering prices? Price can be used to gain more repeat business, but it's costly. It has a direct effect on profit margins: it often conditions the buyer to postpone and wait until there's a price deal. Price is often the weapon of last resort or a short-term fix (that can be very expensive in the long run.) Sustainable price reductions are different, but can only be pulled off by companies with superior cost structures.

From all the data I have seen on the matter, the best way to reap the benefits of steady high levels of cash flow from repeat business would be to make sure that customer satisfaction is high and continually improved upon.

1. Sunil Gupta and Donald R. Lehmann, Managing Customers as Assets: The Strategic Value of Customers in the Long Run (Philadelphia: Wharton School Publishing, 2005).

2. Julian Villanueva and Dominique Hanssens, "Customer Equity: Measurement, Management and Research Opportunities," Foundations and Trends in Marketing 1:7 (2007): 1–95.

Other Resources

- Date

- September 7, 2023

by David Ham | September 7, 2023 With the amount of money involved in professional sports contracts, the current trend toward deeper analysis makes good business sense. However, […]- Date

- June 2, 2023

by David Ham June 1, 2023 I will start by stating the obvious, inflation is forcing consumers to make tradeoffs and difficult decisions. This puts businesses […]- Date

- August 1, 2022

by David Ham August 1, 2022 Five years ago, I wrote a blog that asked, Is This a ‘Hook-Up’ or a Long-Term Relationship? The post was […]- Date

- May 24, 2022

by Omar Khan May 24, 2022 A few years before getting my first job as a consultant, I spent a summer abroad in the United Arab […]