by Mark Galauner January 18, 2022

“You are what you do, not what you say you will do.”- Carl Jung

We all know the saying about the road to a not very nice place being paved with good intentions. Unfortunately, many companies just measure intentions rather than behavior. And if intentions are all your company measures, you are riding in the passenger seat to that very same place!!

And intentions are nice, but they do not tell the whole story. In fact, it could be argued that they don’t tell much of the story at all. For example, it is my intention to clean out the garage…. and maybe one day I will…. if someone can get all the clutter out of the way for me first. So, in the meantime, please watch out for the extra shoes and brooms on the floor when you come into my garage.

We recently asked 500 credit union customers the standard question of “How willing are you to recommend your credit union to others” along with their intention to adopt new products and services. While this information is good to know, for sure, it’s not enough. Behavior is what matters and intentions are not indicative of actual behavior. So, we then later also asked if they had actually referred anyone or adopted anything in the last year.

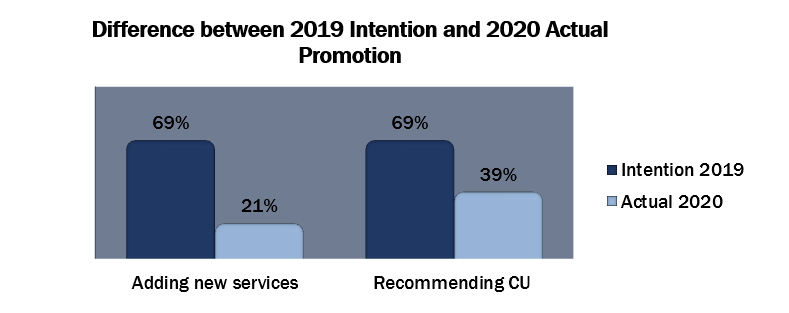

The chart below contrasts “promoters” (score of 9 or 10 on a 10-point scale) for both willingness to recommend and likelihood to adopt new services with their actual behavior of recommending and adopting new services.

As you can see, there is a big difference between the intention and actual behavior. Both are needed to tell the full story. Relying on a single measure a summary statistic leaves a lot of customer behavior unaccounted for. Which is unfortunately the case for many popular customer satisfaction models. It’s kind of like watching a football game through a small hole in the wall. You’d get to see some action and gain a general idea of what was going on, but you probably can’t see the scoreboard. Furthermore, a survey that just measures intentions is limited in that it also doesn’t differentiate between different types of customer behavior. A credit union member displays a high likelihood for “retention loyalty” when they indicate a willingness to refer your business to others. This is different from “purchasing loyalty”, which is shown through adopting (purchasing) new products and services. By measuring behavior, you can easily differentiate their actual loyalty through their actions.

Marketing efforts should focus on diminishing the gap between intention and actual behavior in order to capitalize on the existing good will of your customers and reach out to those who are in the position to either adopt new services or promote your institution. This will help ensure that potential product adoptions and recommendations are not “left on the table”.

Measuring behavior will give you a more accurate and richer summary of customer behavior, even if your garage will still be a mess.

If you’re interested in learning more about credit union customer satisfaction, you can watch me present the results from our latest study here.