By Claes Fornell, Forrest V. Morgeson III, & G. Tomas M. Hult

© 2016, American Marketing Association | ISSN: 1547-7185

RESEARCH

A debate about whether firms with superior customer satisfaction also earn superior stock returns has been persistent. While most studies have examined customer satisfaction using similar data sets and find positive stock returns, conclusions differ with respect to the abnormal returns and whether there is evidence of mispricing. The differences in the findings from these studies confound efforts to express to firms the real value of customer satisfaction – and by extension, the true value of marketing activities in general.

METHOD

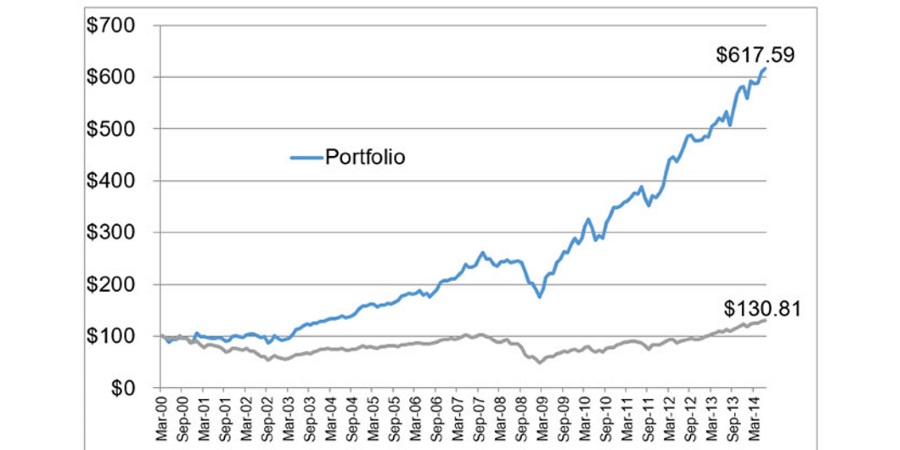

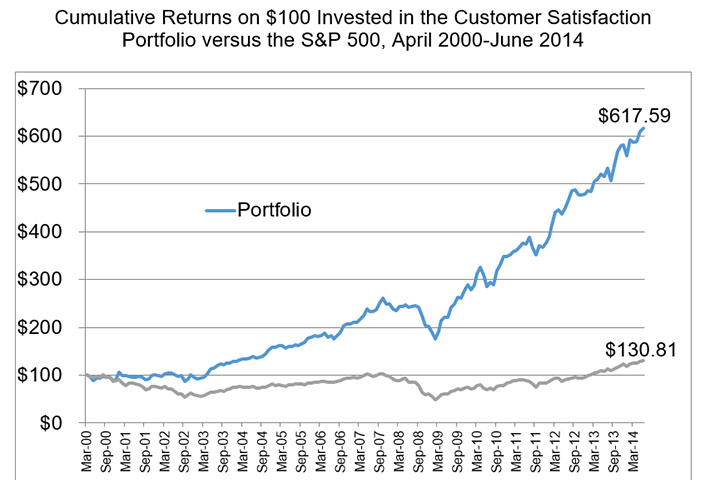

Examining data from the American Customer Satisfaction Index (ACSI), along with both actual stock portfolio returns from a fund trading exclusively on satisfaction information and back-tested returns in Great Britain, we conduct multiple tests to determine the validity of the satisfaction–stock mispricing relationship and to estimate the size of its effect.

FINDINGS

The cumulative satisfaction portfolio returns were 518% over the 15 years studied, compared with a 31% increase for the S&P 500 over the same period. Similar results, using back-tested instead of audited real returns, were found in the United Kingdom. We also find that the effect of customer satisfaction on stock price is, at least in part, channeled via earnings surprises. Consistent with theory, customer satisfaction also has an effect on earnings themselves.

IMPLICATIONS

As suggested by the sheer size of the abnormal returns, the reward for having satisfied customers is much greater than is generally known, generating abnormal stock returns of about 10% per annum. Given this, why are many firms not focusing adequate attention to improving the satisfaction of their customers? The explanation for this phenomenon is likely to be found in inadequate satisfaction data collection and analysis derived from a general misunderstanding of just how valuable satisfied customers are to the firm.

FULL ARTICLE

Claes Fornell, Forrest V. Morgeson III, and G. Tomas M. Hult (2016), “Stock Returns on Customer Satisfaction Do Beat the Market: Gauging the Effect of a Marketing Intangible,” Journal of Marketing, 80 (5), 92-107. doi: http://dx.doi.org/10.1509/jm.15.0229 Other Resources

- Date

- September 7, 2023

by David Ham | September 7, 2023 With the amount of money involved in professional sports contracts, the current trend toward deeper analysis makes good business sense. However, […]- Date

- June 2, 2023

by David Ham June 1, 2023 I will start by stating the obvious, inflation is forcing consumers to make tradeoffs and difficult decisions. This puts businesses […]- Date

- August 1, 2022

by David Ham August 1, 2022 Five years ago, I wrote a blog that asked, Is This a ‘Hook-Up’ or a Long-Term Relationship? The post was […]- Date

- May 24, 2022

by Omar Khan May 24, 2022 A few years before getting my first job as a consultant, I spent a summer abroad in the United Arab […]