by David Ham March 9, 2022

Years ago, I had a client that was an issuer of both retail-branded and major credit cards. I found it interesting how they framed their work as “building balances”. They sought customers who would build balances large enough to generate consistent interest income for card issuers, but not large enough for the customer to fall behind on payments. Unfortunately, we found that building balances was negatively correlated to customer satisfaction. This is a challenge that many retail and service providers look to manage when issuing customer credit.

Recently, I have been thinking about this in the context of an economy disrupted by Covid. So much changed so quickly for consumers. Unemployment jumped in the spring of 2020. Stimulus payments were used to keep cash flowing through the economy. Lockdowns meant less discretionary spending on in-store shopping, dining, travel, and entertainment. As the economy improved, supply chain disruptions continued to limit the availability of bigger ticket items like furniture and automobiles.

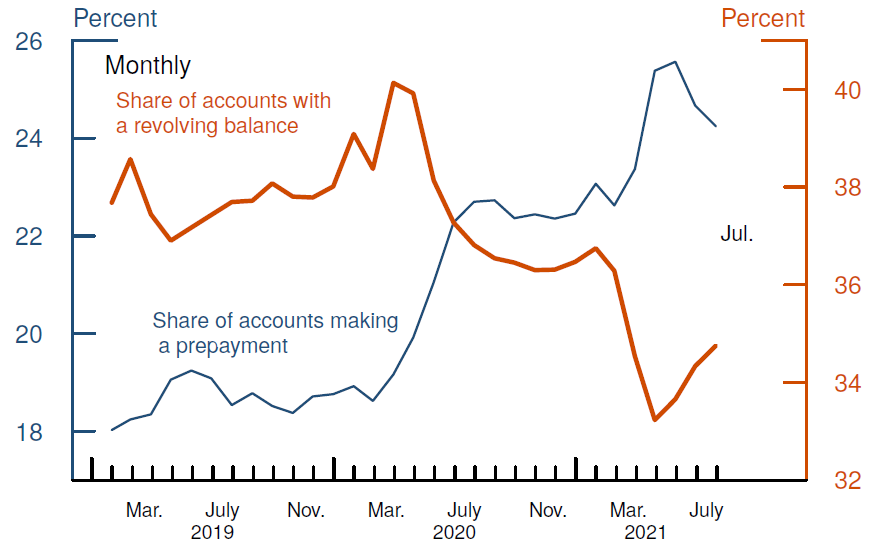

All these changes got me thinking about how credit usage may have changed during the pandemic and how it affected retailers. The following chart comes from a report published by the Federal Reserve Board, Why Did Credit Card Balances Decline so Much during the COVID-19 Pandemic.

“Prepayments and Prevalence of Revolvers” Source: Federal Reserve Board, Form FR Y-14M, Capital Assessments and Stress Testing

Here you can see the relationship between two significant trends. The red line depicts the monthly trend for the share of credit accounts with a revolving balance, while the blue line shows the trend for the share of accounts receiving prepayment. The red line grows steadily in the year leading up to the pandemic but takes a dramatic drop once stimulus checks were issued, which coincides with the blue line skyrocketing. This is a clear indication of a significant portion of consumers paying off credit cards with their stimulus checks.

The same Federal Reserve report also discusses a $120 billion dip in revolving consumer credit in 2020. This 11% decline is the largest of its kind in US history. The decline continued into the first quarter of 2021, sinking by a further $28 billion. In the second half of 2021, consumer spending picked back up as the economy gained steam. However, by year-end, consumer credit balances were still $123 billion below year-end for 2019.

As a customer experience consultant, I kept an eye out for how these changes might have impacted customers’ perceptions of retailer credit offerings. I wondered if credit was starting to lose some of its leverage as a driver of customer satisfaction.

CFI Group applies the proven science of the American Customer Satisfaction Index® (ACSI) as our analytical methodology. We measure beyond performance on the key drivers of customer satisfaction, to quantify the leverage that each driver has for improving satisfaction and influencing customer behavior as well.

Analysis of CFI Group client data indicated that as US consumers paid off more of their revolving debt during the pandemic, credit did indeed become a lower priority driver of customer satisfaction and loyalty. Once credit usage increased again in the latter half of 2021, its influence as a driver of customer satisfaction did too.

How did we do this? How could we detect changes in the economy that affect consumer needs from our client data? Well, we didn’t ask consumers how “important” credit was to them. CFI Group surveys rarely have direct questions regarding the importance of variance drivers, because even the most important factors don’t necessarily drive behavior. Airplane safety is a great example of this. It’s the most important thing for any flight, but customers can expect a safe landing from every airline. Other (less “important”) variables influence customer behavior more, so these are the ones that factor more into our survey research. The result is a model sensitive enough to identify and track trends in real time.

CFI Group uses its sophisticated, proprietary modeling methodology to derive impacts that inform our clients about which aspects of the customer experience have the greatest influence on customer behavior. This is critical to setting priorities for action planning. In this case regarding credit, businesses could focus less on updating credit offerings when changing economic conditions dictate that they have less influence on customer behavior. Those offerings could be reprioritized when the analysis shows that the timing is right.

If you’re interested in how CFI Group can help your organization identify and prioritize the most critical aspects of your customers’ experiences, please feel free to contact us.